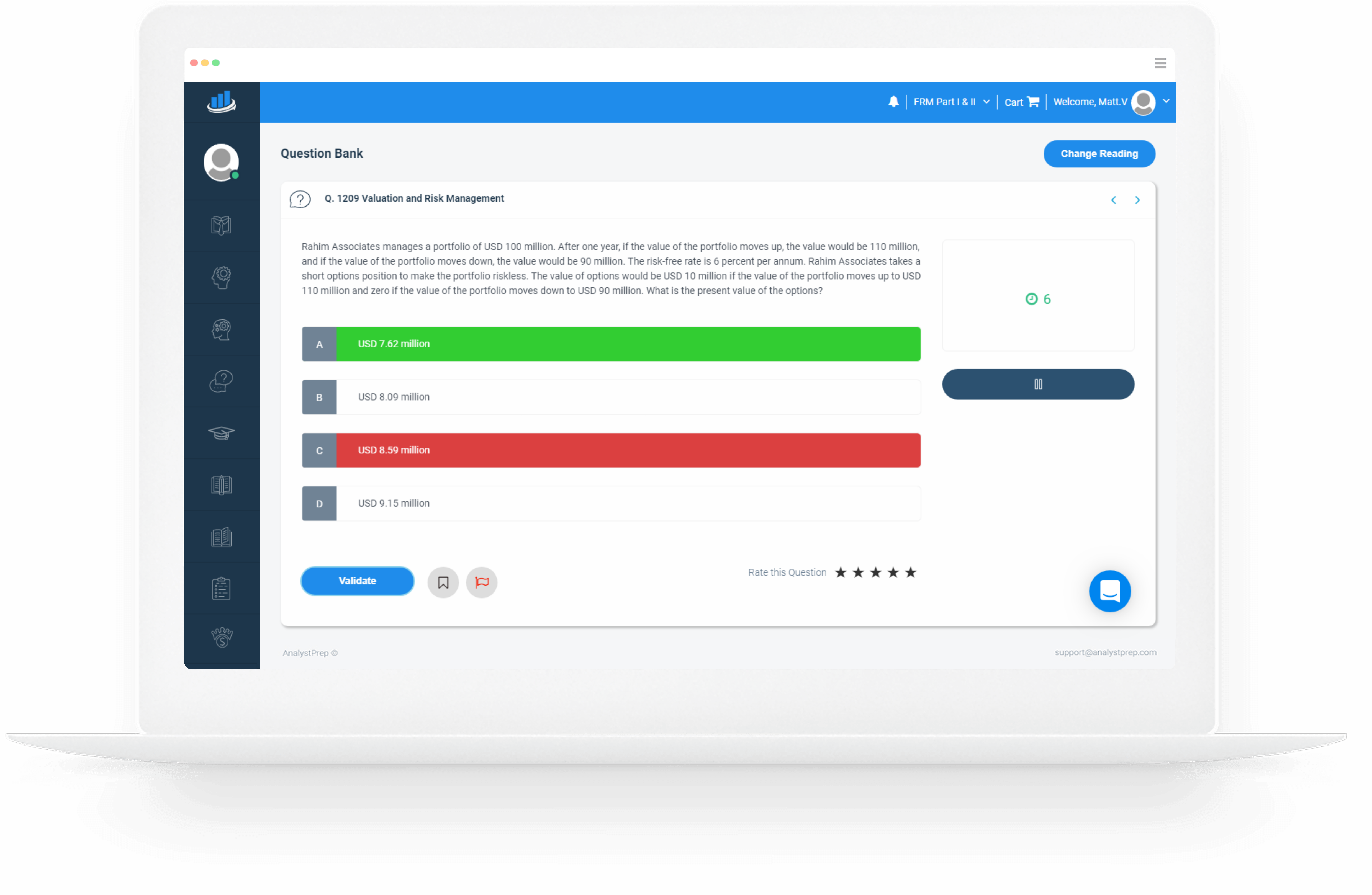

The Science of Term Structure Modelsīruce Tuckman and Angel Serrat, Fixed Income Securities: Tools for Today's Markets, 3rd Edition (Hoboken, NJ: John Wiley & Sons, 2011). Empirical Approaches to Risk Metrics and Hedgesīruce Tuckman and Angel Serrat, Fixed Income Securities: Tools for Today's Markets, 3rd Edition (Hoboken, NJ: John Wiley & Sons, 2011). Financial Correlation Modeling-Bottom-Up Approaches (pages 126-134 only)īruce Tuckman and Angel Serrat, Fixed Income Securities: Tools for Today's Markets, 3rd Edition (Hoboken, NJ: John Wiley & Sons, 2011). Gunter Meissner, Correlation Risk Modeling and Management, 2nd Edition (London: Risk Books, 2019). Empirical Properties of Correlation: How Do Correlations Behave in the Real World? Correlation Basics: Properties, Motivation, Terminology Philippe Jorion, Value-at-Risk: The New Benchmark for Managing Financial Risk, 3rd Edition (New York: McGraw-Hill, 2007). Parametric Approaches (II): Extreme Value Kevin Dowd, Measuring Market Risk, 2nd Edition (West Sussex, England: John Wiley & Sons, 2005). Estimating Market Risk Measures: An Introduction and Overview Don’t get me wrong, overall I feel BT is a must have, but that would be my only gripe.Kevin Dowd, Measuring Market Risk, 2nd Edition (West Sussex, England: John Wiley & Sons, 2005). Maybe it is just me, but it has begun to wear on me. As for my frustration with Bionic Turtle, I can usually follow the questions and answers just fine, but the formatting drives me insane. After taking 1 mock exam from FRM, the questions from Bionic Turtle were much more representative of what I saw in the mock. David is great and the content and questions are challenging and have definitely increased my knowledge. In terms of Bionic Turtle, I have a love hate relationship with it. (I’m generalizing, obviously people have different backgrounds).

As people have stated, you can pass the exam just using Schweser, but I feel like you are playing with fire if that is the route you are going to choose and at best will fall somewhere slightly above the minimum passing score. It does have some merit and is a good summary, but is not comprehensive or difficult enough IMO. I used other materials besides Schweser for CFA and CAIA studies, but if I had only used Schweser I would still feel somewhat confident going into the exam. Out of the 3, Schweser is by far weakest for the FRM. I bought Schweser for my studies, in addition I have used Schweser for both the CFA and CAIA. I’ve put in at least a solid 100/150 hours of studying to this point.

Decided to pursue the FRM since the material interested me.

I’m a CAIA charterholder and CFA Level 2 candidate.

0 kommentar(er)

0 kommentar(er)